Elevate your

business with a

line of credit.

Draw funds as you need and only pay for what

you use, with a flexible line of credit

designed to meet your business needs.

Bluevine is a financial technology company, not a bank. Bluevine's Line of Credit is issued by Celtic Bank, a Utah-chartered Industrial Bank, Member FDIC.

Credit lines up to

$250K

Industry-Leading

Competitive

Rates

Decisions as fast as

5 minutes

Funding that’s fast

and flexible.

Get on-demand access to a revolving line of credit

with no monthly fees.BVSUP-00009

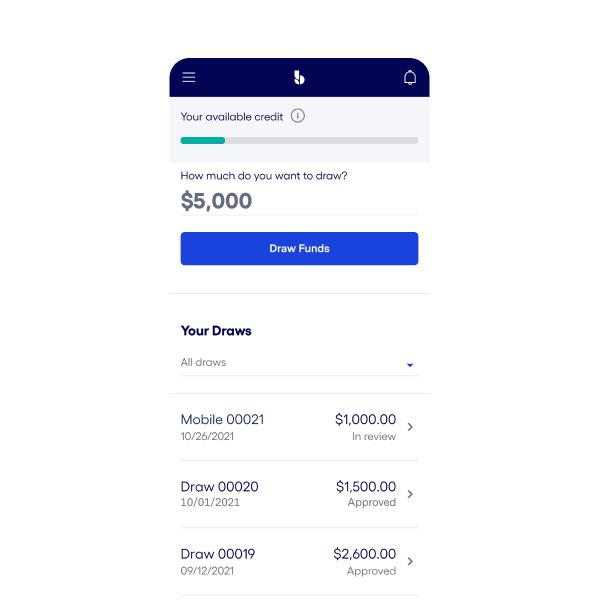

Funds available on demand.

Draw the funds you need with the click of a button.

Only pay for what you use.

No fees for opening, maintaining, prepayment, or account closure.

Access to revolving credit.

Your credit line replenishes as you make repayments.

Financing that grows with you.

Get the right credit limit for your business size at any stage.

How our line of credit works.

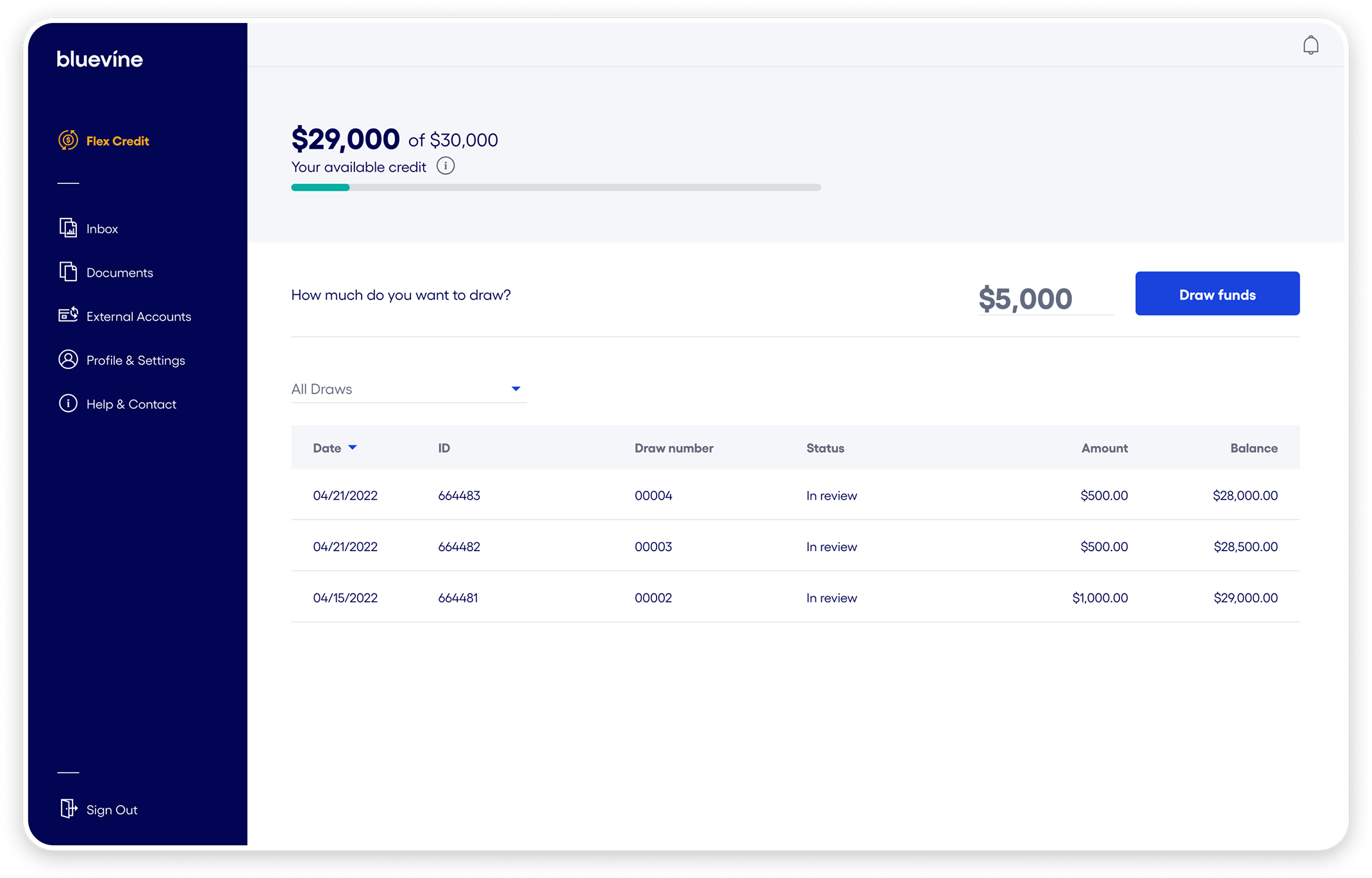

Draw funds, make repayments, and replenish your available credit with ease. With

our quick application, you can apply and get a credit decision in minutes.

Apply online.

Provide basic info about your business and get a decision in as fast as 5 minutes.

Draw funds.

Request funds through your online dashboard and see them in your account within hours.BVSUP-00009

Make repayments.

Pay back each draw with fixed monthly or weekly payments over 6 or 12 months.

Access more funds.

As you pay off your balance, your available credit automatically replenishes.

Get started with our line of credit.

First, provide basic information about your business. If approved, you can request funds from your online

dashboard and receive them in your account in as fast as 24 hours.BVSUP-00009

Minimum qualifications

- 625+ FICO score

- 24+ months in business

- $40,000 in monthly revenue

- Business is operating or incorporated in an eligible U.S. state

What you need to apply

- Basic details about you and your business

- Bank connection or bank statements for past 3 months

- Business is in good standing

Apply for a Line of Credit

with ease.

Helpful guides to show you how to apply and get started with a Bluevine Line of Credit,

plus tips on how to make the most of your funds.

Small business owner’s guide to building and using business credit

Access to cash and credit is a small business’s lifeline. Your business’s credit rating shows lenders, suppliers, and other vendors how financially stable your business is, as well...

Read articleLine of credit FAQs

To apply for a line of credit, apply on our website. We’ll ask you for some basic information about you and your business. Once you apply, we could send you our decision in as little as five minutes.

Just make sure you meet these minimum qualifications:

- In business for 24+ months

- Corporation or LLC

- No bankruptcies in the past 3 years

- In good standing with your Secretary of State

-

Business is operating or incorporated in an eligible U.S. state

-

Ineligible states include:

- Nevada

- North Dakota

- South Dakota

-

Ineligible states include:

- $40,000 in monthly revenue

- 625+ personal FICO credit score

- An active bank connection or statements from the last 3 months (a connected account makes it faster and easier to confirm your information)

Think of a business line of credit as funds your company can request and use if and when you need it. With a Bluevine Line of Credit, you only pay for what you use, and your available credit line replenishes as you make repayments on your draw(s). All draw requests are subject to review and approval. As you build history, the size of your credit line can scale with the size of your business.

A business line of credit provides greater flexibility to your business, allowing you growth opportunities that might not otherwise be available to you. For example, a line of credit can provide financial stability if you encounter unexpected expenses or seasonal fluctuations in revenue.

If you’re looking to boost your growth, you can purchase more inventory or operations equipment, or fund a new marketing campaign. If you’re expanding, a line of credit can help you open a new office or location, or it can support a new product launch.

For your business to qualify for a Bluevine Line of Credit, you must have a personal FICO credit score of at least 625.

Yes—you can apply for a Bluevine Line of Credit as a corporation or LLC.

Yes—you can apply for a Bluevine Line of Credit if you have these two Taxpayer Identification Numbers:

- a Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- an Employer Identification Number (EIN)

Ready to apply?

Submit your application in just a few minutes.BVSUP-00006